Stock depreciation calculation

To calculate the depreciation value per year first calculate the sum of the years digits. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

Carrying Amount Definition Formula How To Calculate

Your adjusted basis in the stock of the corporation is 50000.

. Find rate find time period. To use a depreciation calculator you need to determine which method you want to calculate the depreciated amount for you. Ad Need to Calculate Depreciation.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. Completing the calculation the purchase price subtract the residual value is 10500 divided by seven years of useful life gives us an annual depreciation expense of 1500. 20 Under the ADS depreciation calculations use a straight-line.

Appreciation or Depreciation Rate. Depreciation Base Cost Salvage value Depreciation Base 25000 0. Devaluation of Materials can be done by reducing the Inventory Value wo affecting quantity.

Total Depreciation - The total amount of depreciation based upon. The depreciation base is constant throughout the years and is calculated as follows. You figure your share of the cooperative housing corporations depreciation to be 30000.

Depreciationcost-salvagelife in unitsUnits produced per period. To compute EP depreciation deductions generally must be determined under the alternative depreciation system ADS. Straight line depreciation percent 15 02 or 20 per year Depreciation rate 20 2 40 per year Depreciation for the year 2012 Rs.

Diminishing balance or Written. Appreciation Depreciation Calculator. Profit P SP NS - SC - BP NS BC Where.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Build Your Future With a Firm that has 85 Years of Investment Experience. Depreciation in trading stock.

The depreciation for one period using units of production method is determined using the equation. This can be done through Transactions MR21 MR22. Weve Got You Covered.

In this case it is 15 years or 1 2 3 4 5. The depreciable amount is 9000. 100000 40 912 Rs.

The Stock Calculator uses the following basic formula. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. You can choose any technique ie straight line declining.

For financial statements properly to reflect business costs they have to take account of the wearing out or other reduction in the useful economic life of fixed. You use one half of your apartment. NS is the number of shares SP is the selling price per share BP is the buying.

This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Macroeconomics Capital Stock Depreciation Rate How To Calculate Economics Stack Exchange

Depreciation Rate Formula Examples How To Calculate

Common Stock Formula Calculator Examples With Excel Template

Salvage Value Formula Calculator Excel Template

Shares Outstanding Formula Calculator Examples With Excel Template

How To Calculate Depreciation Expense

Book Value Of Assets Definition Formula Calculation With Examples

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

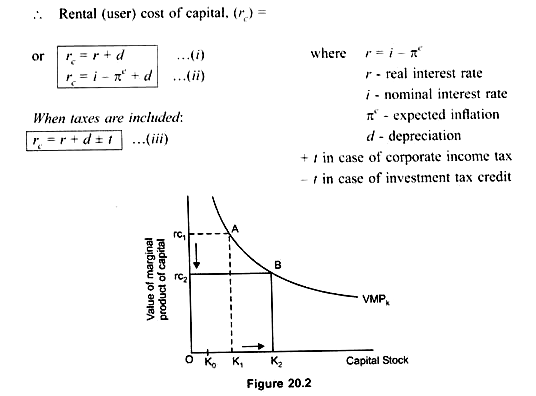

Firm S Demand For The Desired Capital Stock With Diagram

Depreciation Formula Calculate Depreciation Expense